Three Mergers and Acquisitions Changing the Health Insurance Landscape for 2024

Three recent deals—Elevance Health’s proposed merger with Blue Cross Blue Shield of Louisiana (BCBS-LA), Health Care Service Corporation (HCSC)’s proposed acquisition of Cigna’s Medicare Advantage and PDP businesses, and Rite Aid’s sale of its PBM to MedImpact—are shaking up the health insurance landscape.

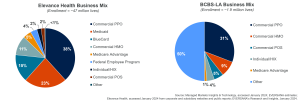

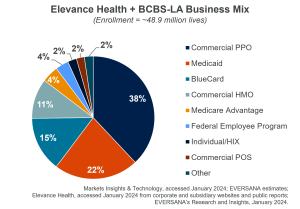

The Elevance Health/BCBS-LA Deal

- Medical lives and geographic reach:

- While the deal does not impact Elevance’s business mix, it significantly increases Elevance’s position in Louisiana (currently at less than 300,000 lives); Elevance would be the top insurer in 12 of its 15 states (including Louisiana—with California, Nevada, and Wisconsin being the exceptions).

- Pharmacy management:

- BCBS-LA currently contracts with Express Scripts and Accredo for PBM/specialty pharmacy services but will likely transition to CarelonRx once its contract expires.

- Implications:

- The deal—which will face significant regulatory scrutiny, given BCBS-LA’s nonprofit status—creates a shift of pharmacy lives from Express Scripts to CarelonRx and the need for biopharmaceutical companies to renegotiate contracts.

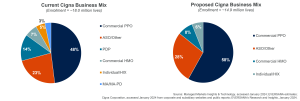

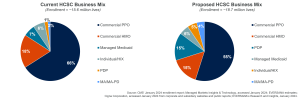

HCSC’s Acquisition of Cigna’s Medicare Business

- On January 31, 2024, Cigna and HCSC announced a $3.3 billion deal for HCSC to acquire all of Cigna’s Medicare business (Elevance Health also expressed interest, but likely bowed out due to its rekindled deal with BCBS-LA).

- HCSC’s Medicare membership would increase from just under 500,000 to more than 3.6 million.

- HCSC is set to gain more than 587,000 MA-only and MA-PD lives and more than 2.5 million PDP lives.

- The deal would expand HCSC’s MA/MA-PD presence from 35 states and the District of Columbia (DC) to 39 states and DC; it would expand its PDP presence from 31 states and DC to all 50 states and DC.

- HCSC would become the fifth-largest Medicare insurer, behind UnitedHealth Group, CVS Health-Aetna, Humana, and Centene.

- Pharmacy management:

- HCSC contracts with Prime Therapeutics for most PBM and specialty pharmacy services; Cigna’s Medicare members will likely transition to Prime in 2025.

- Implications:

- The deal clears a significant hurdle for Cigna to pursue a possible acquisition (e.g., the rumored deal with Humana)

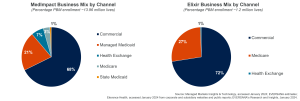

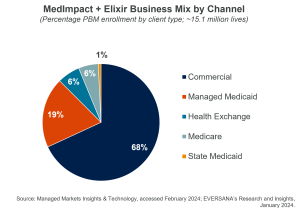

MedImpact’s acquisition of Rite Aid’s PBM, Elixir

- In February 2024, Rite Aid (currently in Chapter 11 bankruptcy proceedings) sold Elixir to MedImpact for $576.5 million.

- The deal adds more than 1 million PBM lives to MedImpact’s membership and increases MedImpact’s mail-order and specialty pharmacy capabilities.

- In addition, it also expands MedImpact’s clinical, technology, health risk management, and consumer empowerment capabilities.

- MedImpact’s chairman and CEO stated:

“This acquisition is the next step in offering connected care solutions to make care more personal, predictive, portable, and affordable for our clients and their members.”

- Implications:

- While not a significant impact on the overall PBM landscape, biopharmaceutical companies could face additional contracting pressures with MedImpact in 2025 due to increased membership, particularly in its Medicare segment.

Contact us at [email protected] to learn more about NAVLIN by EVERSANA and our innovative market research solutions.