Blue Shield of California Moves Against the Big 3 PBMs – But Not Without Their Help

What is driving BS of CA’s decision to adopt a new PBM approach?

BS of CA (Blue Shield of California), a prominent regional Blues plan with 4.8M members and $3.3B in drug spend as of 2022, has made a decisive shift in PBMs, choosing value-driven partnerships over the ‘Big 3’. Insiders (medical and pharmacy directors within the organization) point to ongoing frustrations with the “explosion in pharmacy spend over the last couple of years” and reliance on competitor owned PBMs to manage costs. These frustrations, coupled with recent layoffs linked to financial performance, created a willingness to embrace a new pharmacy model. The change was locked in with the opportunity to save up to $500M in drug costs annually while supporting the formation of a formidable PBM competitor.

How is BS of CA reimagining pharmacy benefits management?

In August 2023, BS of CA made the surprising announcement that it will end its use of CVS Caremark’s PBM services. Instead, the organization is piecing together a transparent model built on an array of established and disruptive partners. Branded ‘Pharmacy Care Reimagined’, the new entity will consist of five partners integrated into BS of CA’s Microsoft Azure cloud platform: Amazon Pharmacy, Mark Cuban’s Cost Plus, Abarca (claims platform), CVS Specialty, and Prime Therapeutics. Insiders expect the new structure to be rolled out on a pilot basis in 2024 before fully launching in 2025.

This innovative approach intends to deliver a seamless, unified, and comprehensive pharmacy experience to its members. While BS of CA will retain CVS Specialty, there is ambiguity around who determines what is considered a “specialty drug,” meaning the plan could omit certain high-cost brands from coverage in favor of lower cost alternatives.

Will BS of CA’s move signal an opening of the PBM floodgates, with other regional Blues and jumbo employers following suit?

Not likely – at least not in the near term.

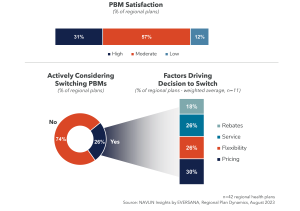

The ‘Big 3’ PBMs have already shifted or are beginning to shift contract structures towards 100% pass-through of rebates (however they are defined) and a reduction in spread pricing to stay ahead of potential reform. There are three factors driving NAVLIN Insights’ prediction that most regional health plans will be hesitant to jump on the alternative PBM bandwagon.

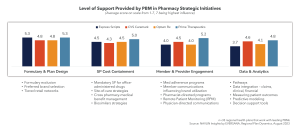

- Increasing transparency and overall regional health plan perceptions that are becoming somewhat more collaborative in supporting pharmacy strategies.

- Conservative approach to managing pharmacy benefits based on fear of the unknown, acceptance of the status quo, and a general “wait and see” approach to transformative change.

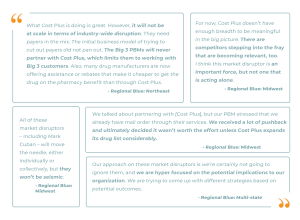

- Lack of confidence in Mark Cuban’s Cost Plus and Amazon relative to alternatives such as GoodRx and existing PBM mail-order infrastructure.

BS of CA is the second regional Blues plan to partner with Mark Cuban’s Cost Plus, following Capital Blue Cross (based in Central PA) in late 2022. Both plans operate in highly competitive regional markets known for their progressive approaches to prescription drug pricing reforms.

What does Pharmacy Care Reimagined mean to biopharma companies?

Biopharma companies need to cultivate direct relationships with pharmacy directors and other influential stakeholders at forward-thinking regional health plans in markets poised for disruption. NAVLIN Insights has deep expertise available now and can help guide your next steps.

Contact us at [email protected] to learn more about NAVLIN by EVERSANA for an in-depth comparative assessment of more than 40 regional health plans. This analysis identifies partnership prospects for your regional account leaders based on quantitative and qualitative insights into pharmacy strategies, responses to trends, partnership dynamics, and forthcoming innovations.