On June 26, 2023, UnitedHealth Group’s Optum division outbid Option Care Health to acquire Amedisys.

Upon completion of the deal (following shareholder and regulatory approval), Amedysis would fall under the Optum Health business segment of Optum. Optum Health provides wellness and consumer engagement programs/tools and health financial services and virtual, in-home, and clinic-based primary, specialty, behavioral health, surgical, and urgent care to more than 100 million individuals and more than 100 payer clients (as of year-end 2022).

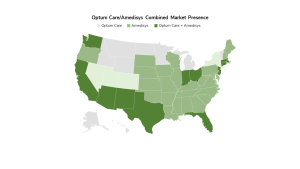

Optum Health employs ~60,000 physicians and operates ~2,000 primary care facilities in Arizona, California, Colorado, Connecticut, Florida, Indiana, Massachusetts, Nevada, New Jersey, New Mexico, New York, Ohio, Oregon, Texas, Utah, and Washington under the Optum Care name.

Amedisys – a publicly traded company based in Baton Rouge, Louisiana – employs ~18,000 individuals, operates more than 500 care centers across 37 states and the District of Columbia, and serves more than 450,000 patients annually. The company’s clients include ~3,000 hospitals and more than 100,000 physicians. Amedisys’ services include in-home skilled nursing, hospice, palliative, and high-acuity care services.

The deal further strengthens United’s position in the home healthcare business (after acquiring LHC Group in February 2023) and Optum’s position as the largest physician employer in the United States.

- All three organizations (Optum Health, LHC Group, and Amedisys) focus on value-based care.

- Amedisys’ and Optum Health’s geographic reach has minimal overlap (11 states); post-merger,

- Optum Care’s presence will span 42 states and the District of Columbia.

“You will see us both developing, if you will, the platform of home care increasingly in a comprehensive fashion, as well as integrating home care with our clinic-based care model. Our ability to embed behavioral healthcare services within our primary care and value-based care offerings has been differentiated and will continue to grow, as well as our utilization of virtual behavioral care solutions in both the home and clinic environments.”

-Wyatt Decker – Optum Health CEO

“Amedisys’ commitment to quality and care innovation within the home, and the patient-first culture of its people, combined with Optum’s deep value-based care expertise can drive meaningful improvement in the health outcomes and experiences of more patients at lower costs, leading to continued growth,”

Patrick Conway, MD – Optum Care Solutions CEO

Implications for Biopharma:

- Optum’s purchase of Amedisys emphasizes Optum’s goal to maintain a diverse business model and invest in in-home health solutions and provider network expansion. Biopharmaceutical companies should continue to closely monitor the evolution of Optum’s business model and any shifts in approaches to care and drug management.

- This merger should also help UnitedHealthcare (UHC) to attract Medicare members; UHC looks to add 1 million Medicare members in 2023. The organization may seek additional biopharmaceutical company programs and partnerships aligned with this initiative. Companies should emphasize how programs and services will support membership growth and elevate experience scores (e.g., CAHPS survey).

- As Optum continues to expand its provider business, biopharmaceutical companies should plan for the organization to continue to invest in value-based care. As Optum’s capabilities expand, the organization may seek assistance with high-risk member identification, outcomes tracking, and total cost of care measurement. Companies would also benefit from emphasizing the role of products in optimizing Optum’s success within value-based contracts.

- Competition for establishing in-home services will continue to increase as all leading payers play ‘catch up’ to Optum’s model. Biopharmaceutical companies should anticipate further payer acquisition of value-based primary care or home health care providers, with organizations such as DispatchHealth, BrightStar Care, and Nurse Next Door representing suitable targets.

A full profile with additional insights on UnitedHealth Group is available as part of the NAVLIN Insights National Account Profiles. Contact us at [email protected] for access and to learn more about NAVLIN by EVERSANA and our innovative market research solutions.