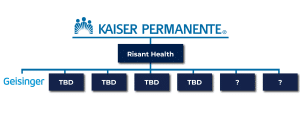

In its first move since acquiring Washington-based Group Health Cooperative in 2017, Kaiser launched Risant Health, a value-based care-focused health system with Geisinger Health as its first health system.

Kaiser – a non profit organization founded in 1945 — operates 39 hospitals, 737 medical centers, a 12.6-million-member health plan, and Permanente Medicine (a for-profit partnership of seven regional medical groups).

Kaiser operates primarily in California but maintains a presence in Colorado, Georgia, Hawaii, Maryland, Oregon, Virginia, Washington, and the District of Columbia.

Kaiser employs all its providers, owns most facilities providing member care, and remains the model for integrated care across the healthcare industry.

Geisinger Health – nonprofit, 12-hospital system based in Danville, Pennsylvania and founded in 1915 — serves 46 Pennsylvania counties and parts of New Jersey.

The system employs more than 1,700 physicians and specialists and operates a 500,000+-member health plan offering commercial (individual and employer group), Medicare, and Medicaid plans.

In conjunction with the announcement, Kaiser launched Risant Health — a nonprofit organization focused on value-based care.

The Risant Health name comes from ‘rise’ and ‘constant’ and represents the organization’s goal to “reach new heights in the industry”

Risant will operate as a separate entity from Kaiser and will be led by Geisinger’s current CEO, Jaewon Ryu, M.D. The new company will maintain headquarters in the District of Columbia metro area.

As the inaugural health system, Geisinger plays an integral role in developing Risant’s operating model and strategy. Geisinger’s commercial health plan ownership, advanced HIT infrastructure, and centralized management of all hospitals and ancillary facilities made it an attractive system to launch Risant’s healthcare vision. In addition, Geisinger’s Pennsylvania presence represents an expansion of Kaiser’s geographic reach.

Kaiser plans an initial $5 billion investment into Risant over the next five years to launch the new organization and add four to six additional health systems.

- Once finalized, Geisinger will retain its name and continue operating as a health system with other payers and provider groups but gains financial and operational support from Kaiser and Risant. This includes tools and resources to strengthen its services, enhance value-based care, leverage pharmacy purchasing power, improve digital offerings, and strengthen health plan product development.

-

- The future of Geisinger Health Plan (GHP) was not discussed, but GHP will likely continue operating under Geisinger for the time being.

- While the deal faces regulatory scrutiny, approval is likely due to the proposed structure of the organization and the lack of geographic overlap between Kaiser and Geisinger.

“Through Risant Health, we will make our value-based care expertise, technology, and services available to community-based health systems, like Geisinger, to strengthen their ability to provide value-based care models with a focus on high-quality and equitable health outcomes.” – Greg Adam, Chair and CEO, Kaiser Permanente

Implications for biopharma:

- Biopharmaceutical companies should anticipate that Kaiser is likely to announce additional health system acquisitions to expand Risant’s operations. Look for Kaiser to pursue systems similar to Geisinger’s profile — midsize, independent systems in regions currently not serviced by Kaiser or Geisinger with a history of focus on value-based care or health plan ownership. We project candidates such as Corewell Health or Sanford Health in the Midwest (both organizations operate a health plan); BayCare, Inova, or Wellstar in the Southeast; or HonorHealth in the Southwest.

- Risant’s focus on value-based care provides biopharmaceutical companies with opportunities to improve relationships through outcomes-based contracting and community health initiatives. Despite Kaiser’s attempt to expand the organization’s geographic reach, pharmaceutical companies should continue to tailor programs and messages to health systems in individual markets and communities. These local customers will value community education, preventive care programs, as well as technology and data support.

- The new organization’s business model and non-profit status signal participation in the 340b Drug Pricing Program — four Geisinger hospitals currently participate — potentially increasing demand from member hospitals for allowed discounts. Pharmaceutical companies who choose to not provide 340b discounts should expect to experience relationship hurdles with these organizations.

- Both Kaiser and Geisinger place a high priority on expanding and leveraging technology to improve outcomes (e.g., artificial intelligence, predictive analytics, and natural language processing). Look for synergies across Geisinger and Kaiser’s technology platforms and opportunities to support all three organizations.