The $740 billion Inflation Reduction Act, signed by President Biden on August 16, 2022, will have significant implications for pharma, payers, and seniors.

The bill implements several significant changes:

- Beginning in 2026, HHS will begin negotiating directly with pharmaceutical companies for the ten most expensive Medicare drugs. The number will increase to 20 new Part D and B drugs in 2029.

- Rebates from pharmaceutical companies if prescription prices in Medicare outpace rate of inflation.

- Medicare Part D redesign — $2,000 out-of-pocket prescription drug cost cap and $0 cost-sharing in catastrophic phase, effective 2025; premium increase protection at 6%.

- For Medicare enrollees, insulin price cap at $35 per month.

- Delay Part D rebate rule to January 2032

- Expand full duals eligibility to 150% FPL

- Three-year extension on health insurance exchange subsidies (originally passed in pandemic relief bill)

Two important components of this bill provide opportunities and challenges for pharma — direct negotiations and Part D redesign.

1. HHS direct Medicare drug negotiations rollout will be slow, but impactful.

- Phase 1: HHS negotiates 10 Medicare Part D drugs. Prices take effect in 2026.

- Phase 2: 15 Part D drugs for 2027.

- Phase 3: 15 Part D and B drugs in 2028.

- Phase 4: 20 Part B or D drugs, taking effect in 2029. The secretary can negotiate 20 drugs in all subsequent years.

Direct negotiations will have significant implications for high-cost Part D and Part B drugs.

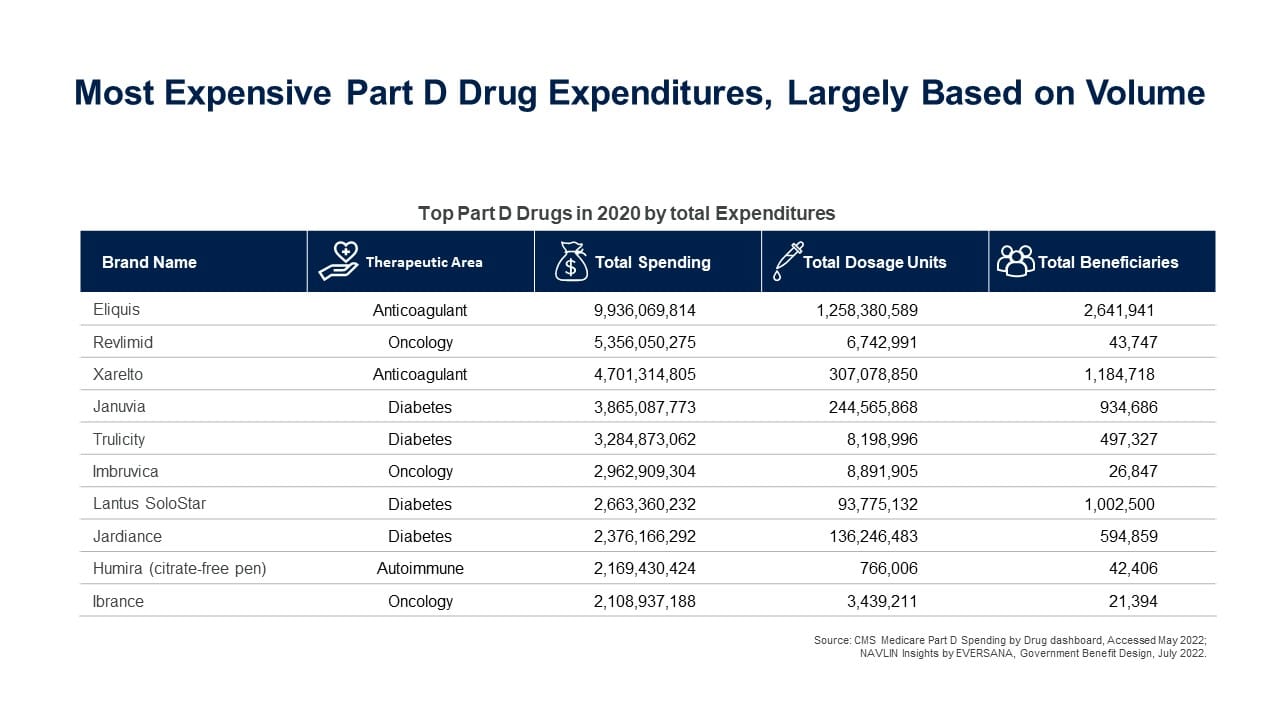

The top 10 most expensive drugs in Part D in 2020 were:

- HHS can only negotiate prices for drugs that Medicare Parts B and D spend the most money on and have been on the market for years without any generic or other competitors and exclude:

- Drugs that have a generic or biosimilar available

- Drugs less than 9 years (for small-molecule drugs) or 13 years (for biological products) from their FDA-approval or licensure date

- Certain “small biotech drugs” (from 2026 to 2028)

- Drugs that account for Medicare spending of less than $200 million in 2021

- Drugs with an orphan designation as the only FDA-approved indication

- Companies face financial penalties for not abiding by negotiated prices — $1 million fines for violating agreement terms, and $100 million fines for providing false information.

- Medicare plans must include drugs for which Medicare negotiates prices on their formularies

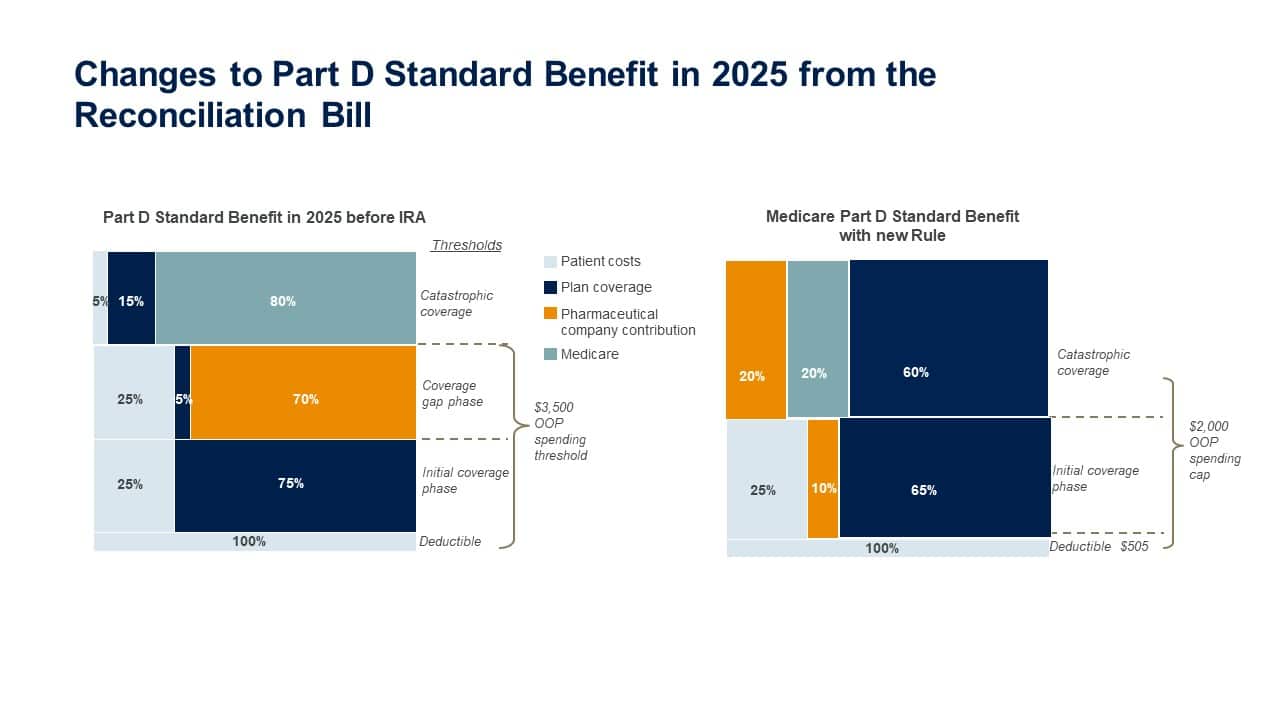

2. A Part D redesign imposes new pharmaceutical liabilities earlier in the benefit cycle and throughout each coverage level. Part D plans face a significant increase in catastrophic coverage responsibility, to 60% from the current 15%.

- Despite a small proportion of beneficiaries reaching the catastrophic phase (approximately 3% of nonsubsidized Part D beneficiaries in 2020), it still represents a significant cost for payers as they are on the hook for 60% of the costs of those individuals.

- Pharma liability will now occur throughout the design from the initial coverage limit (ICL) through the catastrophic coverage phase.

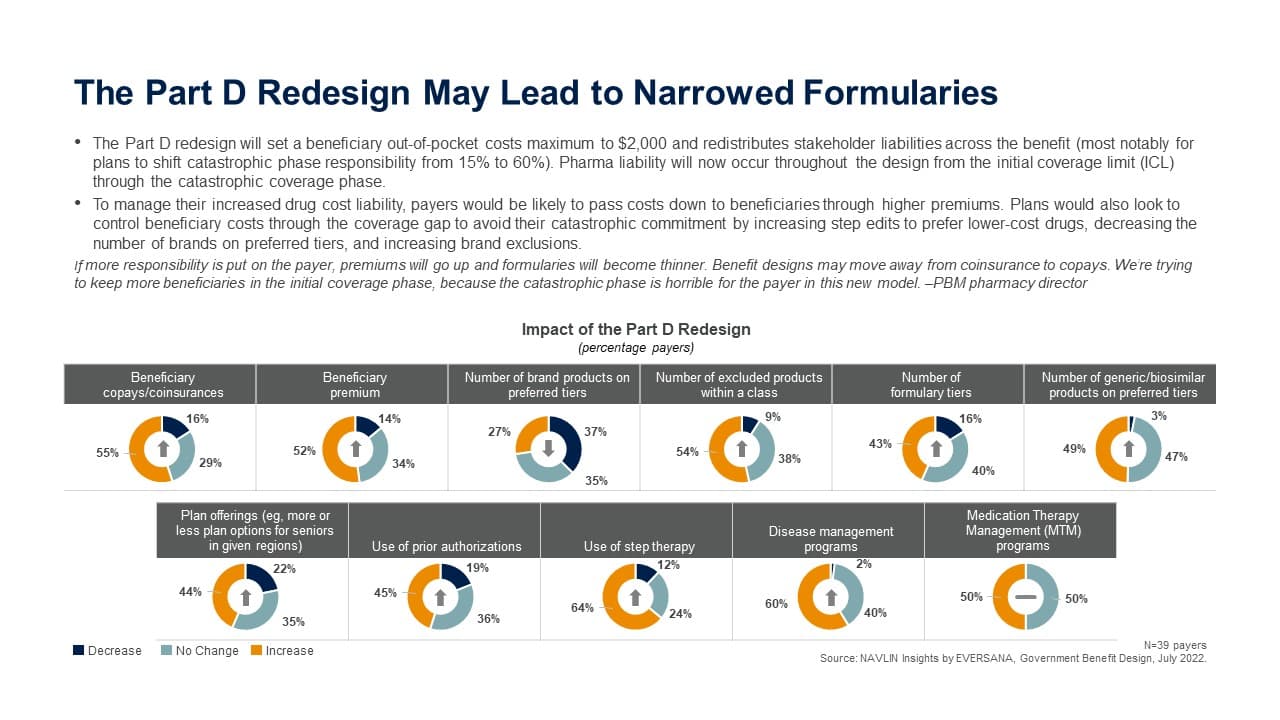

- To manage their increased drug cost liability, payers would be likely to pass costs down to beneficiaries through higher premiums. Plans would also look to control beneficiary costs through the coverage gap to avoid their catastrophic commitment by increasing step edits to prefer lower-cost drugs, decreasing the number of brands on preferred tiers, and increasing brand exclusions.

If more responsibility is put on the payer, premiums will go up and formularies will become thinner. Benefit designs may move away from coinsurance to copays. We’re trying to keep more beneficiaries in the initial coverage phase, because the catastrophic phase is horrible for the payer in this new model. –PBM pharmacy director

Pharmaceutical companies should anticipate shifts in relationships with payers and CMS.

-

-

- CMS has a long road ahead as it collects data to inform decisions about drug selection. Companies with drugs in high-cost area should prepare at least one drug in their classes to be chosen. Preparing for the implications of this altering entire categories of drugs will be important for pharma to consider now.

- Since negotiated drugs must be included on formulary, companies with competitor products should evaluate contracting opportunities in light of new pricing.

- Faced with significant additional reinsurance costs, payers will look to any tools they can to control their members from reaching that phase, including increasing premiums (within the allowable 6%), encouraging more generic use by spreading benefit design cost-sharing and reverting to predictable copay designs and removing more brand drugs from formulary.

- While pharma no longer has a large financial responsibility in the coverage gap, companies now face new liability of 10% in the initial coverage phase and 20% in catastrophic coverage. This lability will apply to ALL Part D beneficiaries.

-